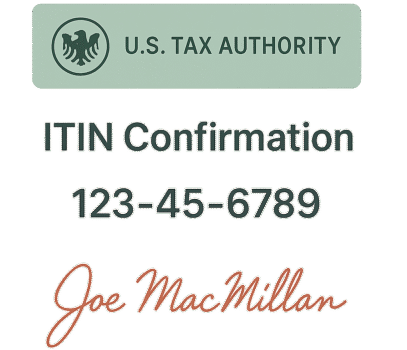

If you’re a non-U.S. resident earning income in the United States — through a U.S. LLC, online platforms, or other business activities — you may need an ITIN (Individual Taxpayer Identification Number) to comply with IRS tax rules.

At INCHUB LLC, we help you apply for your ITIN the right way — with certified documentation, proper filing, and full guidance throughout the process.

INCHUB helps non-U.S. residents form legally registered LLCs in any U.S. state

Recommended

INCHUB helps non-U.S. residents form legally registered LLCs in any U.S. state

All packages include document preparation, review, and submission via IRS-accepted channels.

Processing time depends on IRS workload and completeness of your file

An ITIN is a tax ID for individuals who are not eligible for a U.S. Social Security Number. It’s needed to comply with IRS tax rules and access financial tools.

Yes. Our process is fully remote and accepted by the IRS. No travel or in-person meetings required.

Yes, in many cases. The EIN is for your company. The ITIN is for you as a non-resident individual.

Normally 6–12 weeks, but sometimes faster if filed through a Certified Acceptance Agent.

Yes — having an ITIN allows you to benefit from tax treaties and file for refunds legally.

Non-residents with U.S. LLCs or Corporations

Freelancers working with U.S. clients

Amazon, YouTube, or platform-based earners

Non-resident founders needing tax ID for Stripe/PayPal

Anyone required to file U.S. taxes without SSN